Digital Tokens, Crypto-Assets and the CRWD Network

The Introduction of Tokens

Tokens as we know them today, have been introduced to the Blockchain ecosystem in late 2015 after Fabian Vogelsteller suggested an “Ethereum Improvement Proposal” EIP-20. Vitalik Buterin and Vogelsteller defined this “standard interface for tokens” which is widely known today as ERC20. This introduced a very convenient way to create, introduce and manage digital tokens on the Ethereum platform - and largely changed the way of how digital assets are regarded today.

The new token standard introduced by Ethereum became widely popular mainly because of ICOs (Initial Coin Offerings), although tokenisation technically has been existing before ERC20. Before there have been Ethereum tokens, new “coins” have been introduced to the cryptosphere as “copies” of Bitcoin (code-forks), with adapted technological and economic parameters. In the 2014 paper “Cryptocurrencies as Distributed Community Experiments”, the so-called “altcoins” (alternatives to Bitcoin) have been described as “hypotheses [...] until they can show a significant user-base”.

The Game-Changer Ethereum

The game has changed through Ethereum, as ERC20 as standard not only made it easier to create and issue these tokens (they all are based on the same technological layer), but a huge advantage of ERC20 is that token creators don’t need to make sure that people are running specific software, nodes or other infrastructure, as has been the case with altcoins. ERC20 is based on the Ethereum platform, and tokens are safe, secure and exchangeable - as long as Ethereum itself exists. According to Cointelegraph, companies raised around $6 billion via ICOs in 2017; and Ethereum makes over 80 percent of the market.

It is safe to say that Ethereum, the platform that introduced this infrastructure, has started and significantly increased the use of digital tokens. As of April 2018, etherscan, the Ethereum Blockchain explorer, lists over 66160 ERC20 Token contracts, with new tokens being introduced almost every minute, while coinmarketcap only lists 573 Ethereum based tokens which are actually traded on online exchanges. The reasons for that significant difference is not only market failure of the rest of the tokens, but can also be described through the legal implications that came with the introduction of these new digital assets.

How to Regulate Tokens

In July 2017, the Securities and Exchange Commission (SEC) in the US ruled the digital assets that are sold via Initial Coin Offerings (ICOs) as securities, with adding that specific facts and circumstances of each case should be taken into account. At the beginning of 2018 there is a huge difference of legal implementations and even bans worldwide, with the current state of ICO regulations around the globe being more or less imprecise and still opening up enough space for malicious players to act. This not only poses a problem for investors, but also makes it a very complicated procedure for legit businesses to utilize the opportunities and possibilities of blockchains and new cryptographic assets, as regulations are also enforced at the investor’s location, and not only at company location.

This insecurity is also proven by the stands of many other countries that are unsure of how to regulate tokens in general, on the example of jurisdictions like Poland, Russia, Singapore and even the UK that simply stated on tokens and ICOs - “depending on how they are structured, they may, therefore, fall into the regulatory perimeter” (source).

New Classification of Tokens

Switzerland is one of the first countries that has proposed a legal framework for how tokens can be classified, with the possibility of tokens being of mixed-nature as well. This initial classification is a huge leap forward and will foster clarity and stability in the field. With the largely undefined nature of the cryptocurrency and blockchain space, long term planning has been a challenge in this emerging sector, especially for SMEs and startups. A lot of new actors refrained from using crowdfunding or crowd-investing strategies via ICOs, which will change in the near future, as clear legal outlines are on the horizon. The Swiss Financial Market Supervisory Authority FINMA recently described in a press release, how it intends to apply financial market legislation in handling enquiries from ICO organisers. While still referring to a “case-by-case basis”, the FINMA categorises tokens into the three types, with hybrids possible:

- payment tokens (synonymous with cryptocurrency)

- utility tokens

- asset tokens

Newer projects like polymath, t0 and CRWD network utilize the concepts of two or more token types at once to implement their projects and utilize the combination of real world identities with blockchain addresses to grow the ecosystem. Identification is named as one of the most valuable tools that many people want inside the crypto ecosystem, as recently identified in a twitter poll by Luis Iván Cuende, one of Forbes Europe’s 30 under 30.

CRWD Network Tokens

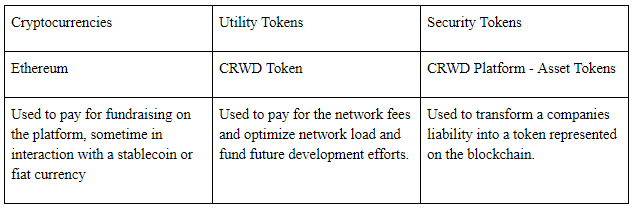

In case of the CRWD project the three tokens utilized to achieve the decentralized infrastructure idea are:

Besides these three, a fourth or non tradeable type of investor verification key is utilized as an unspendable ‘token’ that proves the follow through on formal verification procedures.

A combination of current token models enables newly created asset tokens to exist and the future of those security styles tokens will be bright as they can convince potential investors bound by legal restrictions to take their first step onto the regulated subset of the blockchain ecosystem.

Read more how this regulated subset will come about in the whitepaper at ico.conda.online.

**CRWD network brings clarity and stability into the world of tokenized equity offerings. We are building a decentralized network protocol for SMEs, Start-ups and Real Estate Projects. **