The era of Initial Coin Offerings

The IPO of the decentralized future

ICO is the buzzword of the year 2017. Similar to the phrase “Startup Unicorn” it rapidly found its way to startup pop culture. (Check out this YouTube link.)

At many blockchain and cryptocurrency related events i have presented, I repeatedly encountered the question ‘have you invested in an ICO’. This supersedes the ‘do you own bitcoin’ question, which largely dominated throughout the years 2012-2016. People who now own Bitcoin or Ether have at least heard about ICOs and marketing credit as well, as ICOs have become big business, with currently 3108 ICOs from 338 different countries listed on the website icobench.com as of May 2018 alone. This does not include other forms of crowdsales or cryptocurrency projects which did not undergo the ‘traditional’ way of Initial Coin Offering.

Investors who formerly didn’t voice an opinion on Bitcoin in order to not risk their reputation now have crypto-assets in their portfolio. The Rockefellers recently joined Rothschilds & Soros, just to name a few prominent cryptocurrency ‘investors’. The perception of the general public that cryptocurrency and crypto assets are only for dark markets and illicit use is largely replaced by a hype which is largely dubbed ‘investment’, while it can be more seen as high-risk venture capital.

Examples such as Request Network and Quantstamp (both of which are ICO startups from the prestigious ycombinator startup incubator), are pointing to the fact, that traditional venture capital is undergoing a transition, introduced through novel crowdsale models based on cryptocurrency and the blockchain. Early Bitcoin-based ventures, which took a Bitcoin maximalist stance, changed their minds and jumped on the tokenization bandwagon, on the example of 21.co, an early startup who “opted to move away from the increasingly popular ICO model because it’s looking to build engagement, not raise funds” (source: techcrunch).

The influence of ICOs on Ethereum

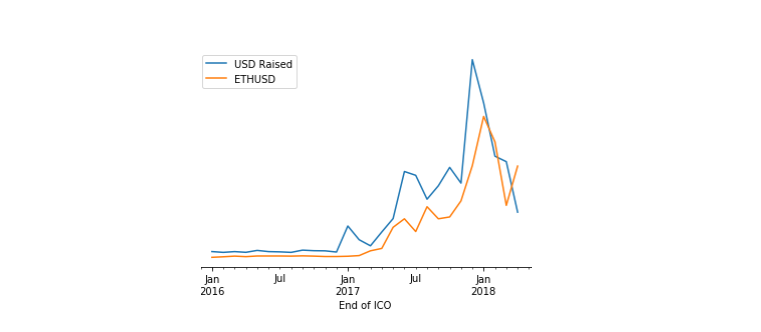

Figure 1: Funds raised by ICOs (end date) per month vs. ETH price normalized, data from icodata.io & cryptocompare.com

Through all these tokenization pressure we can see that market value of Ether and funds raised by ICOs also appear to be correlated. As Figure 1 shows when observing normalized Ether price data in comparison with ICO investments per month the trends seem very similar. This offers room for hypothesizing that the rise in ICOs subsequently helped the Ethereum price to develop and might lead us to believe that many Initial Coin Offering investors were prior Ethereum investors opting to diversify. Besides the benefit of not having to convert to fiat currencies in between there are advantages and disadvantages for people to invest in utility ICOs compared to more traditional investments.

ICO strengths and weaknesses

Tokens seem to be more robust investments, as investors actually have something in your hand, or in other words, ’on your ledger nano’ (on the example of Ethereum-based ERC20 tokens). If you are not an angel investor spending all your time in meetings with stressed out founders for years, you can invest on the ground level and never interact with the supported project at all. While one can argue that investors gave away direct influence, is can be pointed out that they now gain the option to pull support at any minute and not just in funding rounds. Projects that will truly innovate in the space and make their token a usable form of value will build a totally new economy, so these big visions in turn offer big long term gains for investors with adequate big risks.

It seems that ICOs fill the space that was left by ‘accredited investor’ laws. In many countries investors are only allowed to fund high risk projects when they show a significant net worth. Erik Voorhees pointed out in a tweet, that the “[.] SEC has created an environment where only the rich [..] are able to get access to financial deals”. That leads to a skewed capitalistic world where the majority of investors in terms of single individuals joined in at time of the IPO after rich investors were able to make earlier bets. ICOs totally change the playground as big early investment firms lose their power and anyone can invest at the ground level of any given project. ICOs show how big the market for high risk investments by non-superrich individuals actually is, even without legal backing.

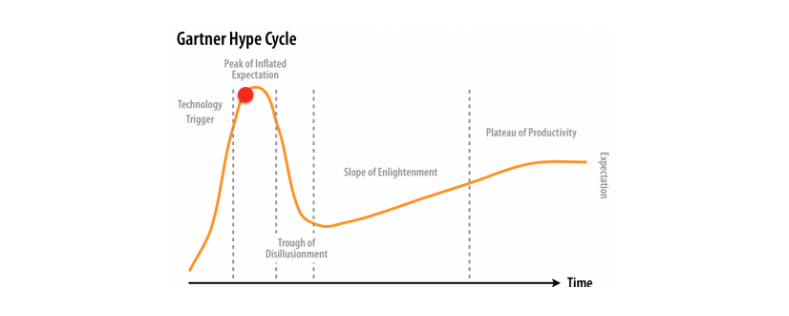

Figure 2: Gartner Hype Cycle

On the negative side, some ICOs run on the hype of high expectations (See Figure 2). Cryptocurrency investors seem to partly understand product as well market risks, while the token’s economic aspects barely matter to them right now. In many cases it seems it is important to have a great vision for the technology rather than for the further development of the token, which might create long term problems for some projects. This is also reflected in the notation that we have seen valuations that would have been hard to achieve in traditional pre-product fundraising rounds. A prominent example is the Blockchain data storage network Filecoin, which raised $257 million and set an ICO record in late 2017.

There are and will be 5 forms of token deaths:

** **Early failures

- ICO exit scams that never intended to build a product sadly often linked to mainstream celebrities.

- Pyramid models (ponzi schemes) where participants ignore visible red flags.

And later stage failures

- Product Failures - Badly implemented startup ideas that claim they are not scams, but can’t deliver.

- Market Failures - Well implemented projects that innovate and do everything right, but fail without having long term cryptoeconomic effects behind their token.

- Cryptoeconomic Failures - The new category. Projects that even get to worldwide technology adoption, but loose their token value regardless through bad cryptoeconomics like no holding incentives or high inflation rates diluting investors.

The past has shown that these things happen. It motivates the case for a legal framework backing tokens for those startups that are in need for a liquidity solution in their fundraising process, but cryptoeconomic design is not in the nature of their business.

Benefits of the upcoming security token era

Security tokens can help mitigate early token startup failures (1 and 2) and help with cryptoeconomic failure. Security tokens bind the token value to the company value, which can open up a big market segment for early stage non-crypto related projects.

There are reasons to believe that traditional investors are partly mislead with the current ICO market, because they are different in nature (e.g. Investments are tethered to Ether and not to fiat, cryptoeconomic effects are hardly factored in). Security tokens on the other hand will be more natural to investors, as less variables will have to be considered for project evaluation. They offer easier access to startup fundraising in a cryptocurrency future resembling our traditional investment approaches.

Finally, a new era of security tokens could bring the wild ICO landscape back to sanity, and through that also closer to where the abbreviation originates from: the IPO.